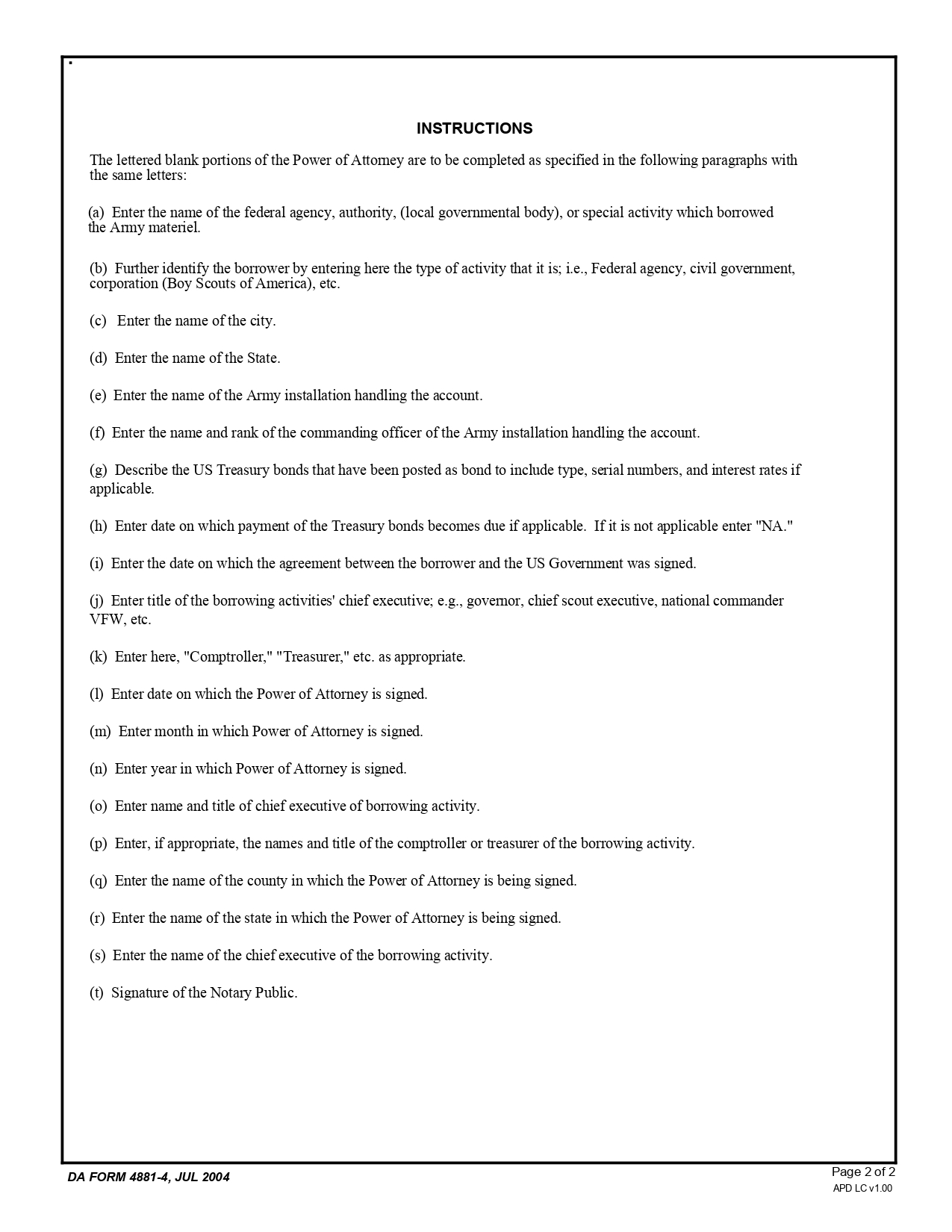

DAFORMFILLABLE.COM | DA FORM 4881-4 Fillable – Army Pubs 4881-4 PDF – DA FORM 4881-4, titled Power Of Attorney (For Transactions Involving Treasury Bonds), is a critical document used for authorizing an individual to perform transactions involving Treasury Bonds on behalf of another person. This form is particularly important in financial and legal contexts, where precise and clear authorization is essential for the management of bonds and other financial instruments.

DA FORM 4881-4 – Power Of Attorney (For Transactions Involving Treasury Bonds)

| Form Number | DA Form 4881-4 |

| Form Title | Power Of Attorney (For Transactions Involving Treasury Bonds) |

| Form Date | 07/01/2004 |

| Form Proponent | G-4 |

Key Information

- Pub/Form Number: DA FORM 4881-4

- Pub/Form Date: 07/01/2004

- Pub/Form Title: Power Of Attorney (For Transactions Involving Treasury Bonds)

- Pub/Form Proponent: G-4

- Pub/Form Status: ACTIVE

- Prescribed Forms/Prescribing Directive: AR 700-131

- Security Classification: UNCLASSIFIED

- Distribution Restriction Code: A (Approved for public release; distribution is unlimited)

- Pub/Form IDN: 990001

- Pub/Form PIN: 046111

Purpose and Use of DA FORM 4881-4

The primary purpose of DA FORM 4881-4 is to grant legal authority to an individual (the attorney-in-fact) to act on behalf of another person (the principal) in transactions involving Treasury Bonds. This Power of Attorney is crucial for ensuring that transactions are conducted legally and with proper authorization.

Importance of Power of Attorney in Financial Transactions

A Power of Attorney (POA) is a legal document that allows one person to act in another’s place. In the context of Treasury Bonds, this form is essential for managing the bonds, including buying, selling, and other financial activities. The DA FORM 4881-4 ensures that these transactions are conducted smoothly and without legal complications.

Detailed Breakdown of DA FORM 4881-4

Sections of the Form

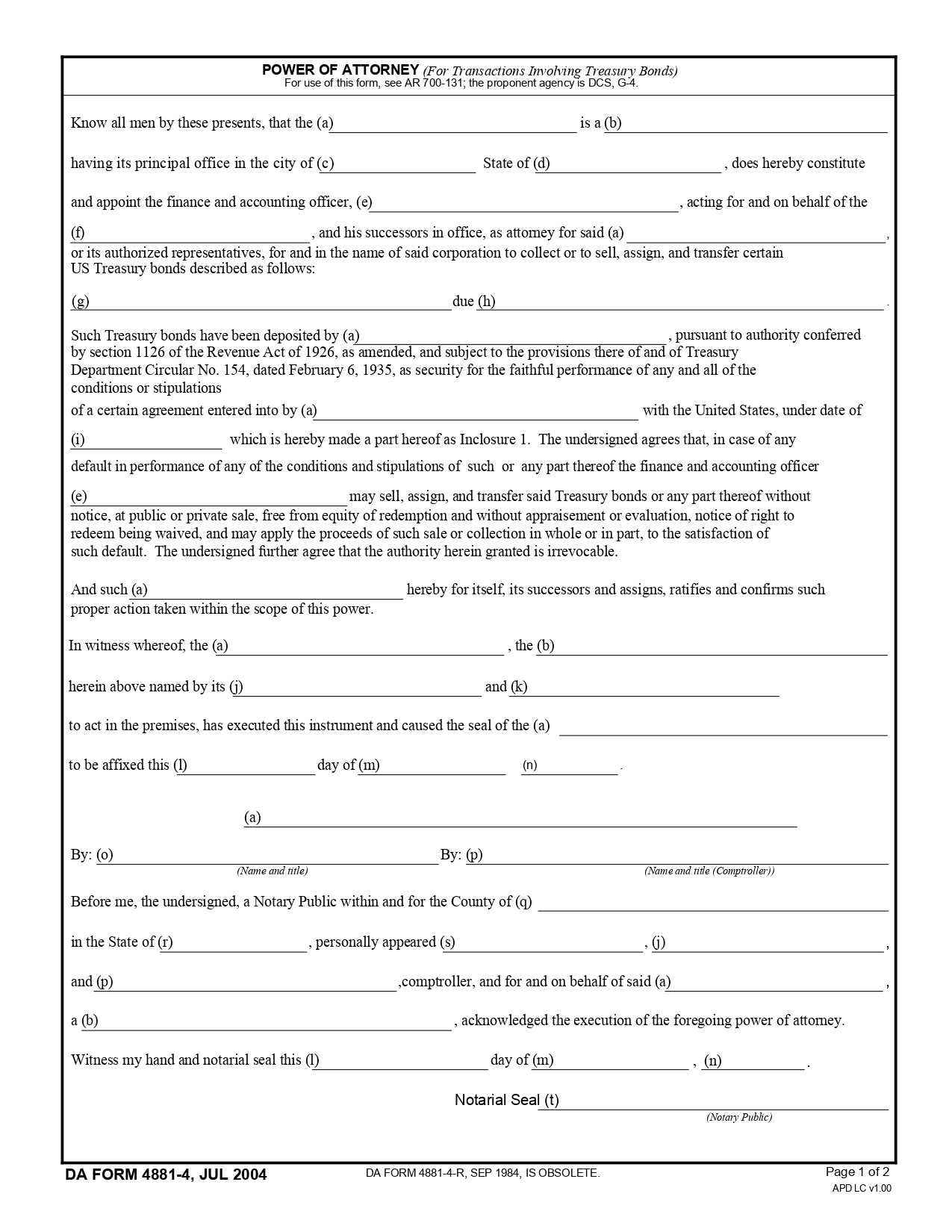

DA FORM 4881-4 comprises several sections that need to be carefully filled out to ensure its validity and effectiveness:

- Principal Information: This section captures the details of the person granting the power of attorney.

- Attorney-in-Fact Information: This section details the person who is being granted the authority to act on behalf of the principal.

- Scope of Authority: This section outlines the specific transactions and activities that the attorney-in-fact is authorized to perform.

- Duration of Authority: This section specifies the time period during which the power of attorney is valid.

- Signatures and Notarization: This final section requires the signatures of both the principal and the attorney-in-fact, along with notarization to validate the document.

Filing and Submission

Once completed, DA FORM 4881-4 must be submitted according to the guidelines prescribed in AR 700-131. It’s essential to ensure that all sections are accurately filled out and that the form is properly notarized to avoid any legal issues.

Security and Distribution

The DA FORM 4881-4 is classified as UNCLASSIFIED and is approved for public release with unlimited distribution. This means that there are no restrictions on who can access or use the form, making it widely available for individuals who need to authorize transactions involving Treasury Bonds.

Electronic Availability

As noted in the footnotes, the DA FORM 4881-4 is only produced in electronic media. This ensures ease of access and distribution, allowing individuals to easily obtain and complete the form as needed.

Conclusion

The DA FORM 4881-4 – Power Of Attorney (For Transactions Involving Treasury Bonds) is a vital document for authorizing transactions involving Treasury Bonds. It provides a clear and legally binding way for individuals to grant authority to others, ensuring that financial transactions are conducted smoothly and with proper authorization. Understanding and correctly utilizing this form is crucial for anyone involved in managing Treasury Bonds.

By following the guidelines and ensuring all sections of the form are accurately completed and notarized, individuals can effectively manage their financial transactions with confidence and legal assurance.

DA FORM 4881-4 Fillable – Army Pubs 4881-4 PDF DOWNLOAD