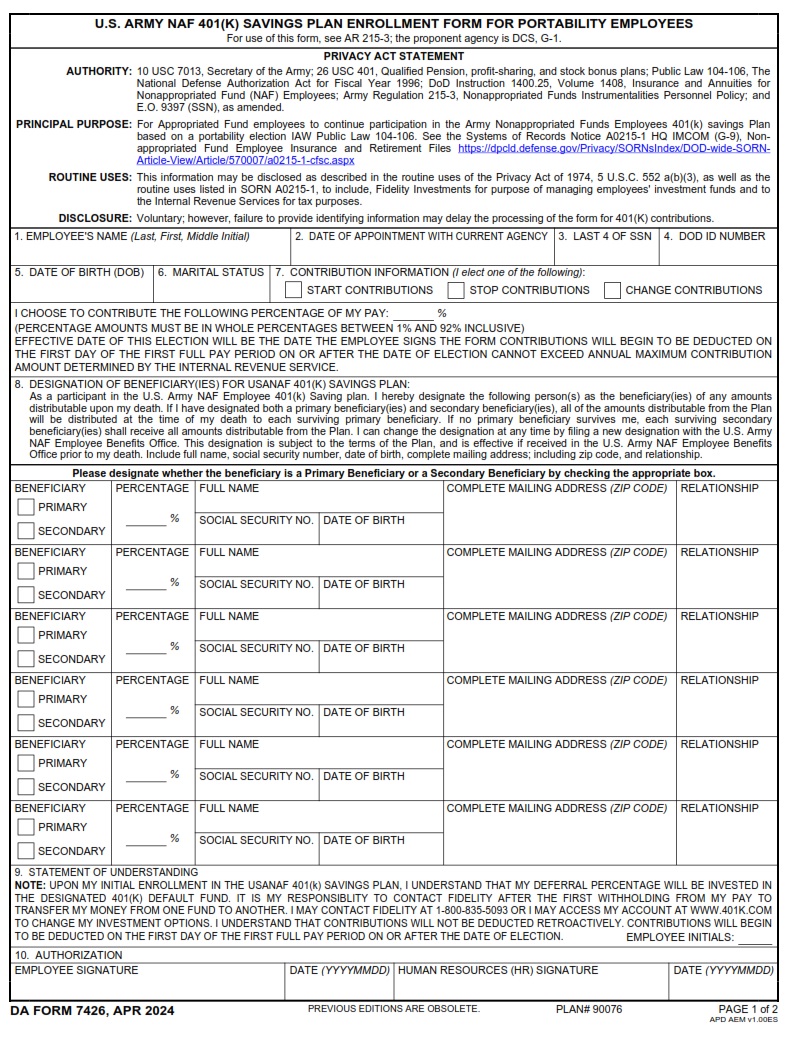

DAFORMFILLABLE.COM | DA FORM 7426 Fillable – Army Pubs 7426 PDF – The DA FORM 7426 – Application for USANAF Employee 401(K) Savings Plan Enrollment Form is an essential document for employees of the United States Army and Air Force (USANAF) looking to enroll in a 401(K) savings plan. This form helps facilitate the process of enrolling in a retirement savings plan, ensuring that employees can secure their financial future. Below, we provide a comprehensive guide to understanding and using DA FORM 7426.

DA FORM 7426 – Application For USANAF Employee 401(K) Savings Plan Enrollment Form

| Form Number | DA FORM 7426 |

| Form Title | Application For USANAF Employee 401(K) Savings Plan Enrollment Form |

| Form Date | 3/1/2024 |

| Form Proponent | G-1 |

Overview of DA FORM 7426

Publication Details

DA FORM 7426 is a PDF document that was updated on March 1, 2024. This form, previously updated on June 1, 2020, has been revised to reflect current policies and procedures. The form is categorized as UNCLASSIFIED and is approved for public release, meaning it is widely accessible and can be distributed without restriction.

- Pub/Form Number: DA FORM 7426

- Pub/Form Date: 03/01/2024

- Pub/Form Title: Application for USANAF Employee 401(K) Savings Plan Enrollment Form

- Pub/Form Proponent: G-1

- Pub/Form Status: ACTIVE

- Prescribed Forms/Prescribing Directive: AR 215-3

- Dist Restriction Code: A APPROVED FOR PUBLIC RELEASE; DISTRIBUTION IS UNLIMITED

Purpose of DA FORM 7426

The primary purpose of DA FORM 7426 is to facilitate the enrollment of USANAF employees into the 401(K) savings plan. This plan allows employees to save a portion of their salary in a tax-deferred account, which can significantly aid in their retirement planning. Enrolling in a 401(K) plan is a critical step for employees who want to ensure financial stability and security in their post-service years.

How to Use DA FORM 7426

Steps for Completing the Form

- Personal Information: Employees must fill out their personal details, including name, address, and Social Security Number. Ensuring that all information is accurate is crucial for the enrollment process.

- Employment Information: Include current employment details, such as job title, department, and employment start date. This information helps verify eligibility for the 401(K) plan.

- Contribution Amount: Specify the amount or percentage of the salary that the employee wishes to contribute to the 401(K) plan. Employees should consider their financial goals and retirement plans when determining this amount.

- Beneficiary Designation: Designate one or more beneficiaries who will receive the benefits of the 401(K) plan in case of the employee’s death. This ensures that the savings are distributed according to the employee’s wishes.

- Signatures and Date: The form must be signed and dated by the employee to confirm the accuracy of the information and to officially apply for the 401(K) savings plan.

Submission Process

Once the form is completed, it should be submitted to the appropriate department as indicated in the form’s instructions. Typically, this would be the human resources or personnel office responsible for handling employee benefits.

Benefits of Enrolling in a 401(K) Plan

Tax Advantages

One of the most significant benefits of a 401(K) plan is the tax advantage. Contributions made to a 401(K) plan are typically tax-deferred, meaning employees do not pay taxes on the money until it is withdrawn. This can result in substantial tax savings over time.

Employer Matching Contributions

Many employers offer matching contributions to employees’ 401(K) plans. This means that for every dollar an employee contributes, the employer will also contribute a certain amount, effectively increasing the total savings without additional cost to the employee.

Financial Security

By consistently contributing to a 401(K) plan, employees can build a substantial nest egg for retirement. This ensures a financially secure future, allowing employees to maintain their standard of living even after they have stopped working.

Frequently Asked Questions

1. What happens if I leave my job?

If an employee leaves their job, they have several options regarding their 401(K) plan. They can choose to leave the money in the current plan, roll it over into a new employer’s plan, or roll it over into an individual retirement account (IRA).

2. Can I change my contribution amount?

Yes, employees can usually change their contribution amount during the plan’s open enrollment period or under certain qualifying events. It is important to review the plan’s rules and regulations for specific details.

3. How are my investments managed?

401(K) plans typically offer a range of investment options, including mutual funds, stocks, and bonds. Employees can choose how their contributions are invested based on their risk tolerance and retirement goals.

Conclusion

Enrolling in a 401(K) savings plan using DA FORM 7426 is a crucial step for USANAF employees to secure their financial future. Understanding the form and its requirements ensures a smooth enrollment process. By taking advantage of the tax benefits, employer contributions, and investment options, employees can build a solid financial foundation for their retirement. For more detailed information and to download the form, employees can visit the official USANAF resources or consult their human resources department.